Private and Public Supply of Liquidity (Journal of Political Economy, Vol. 106, No. 1, February 1998) - Five Books Expert Reviews

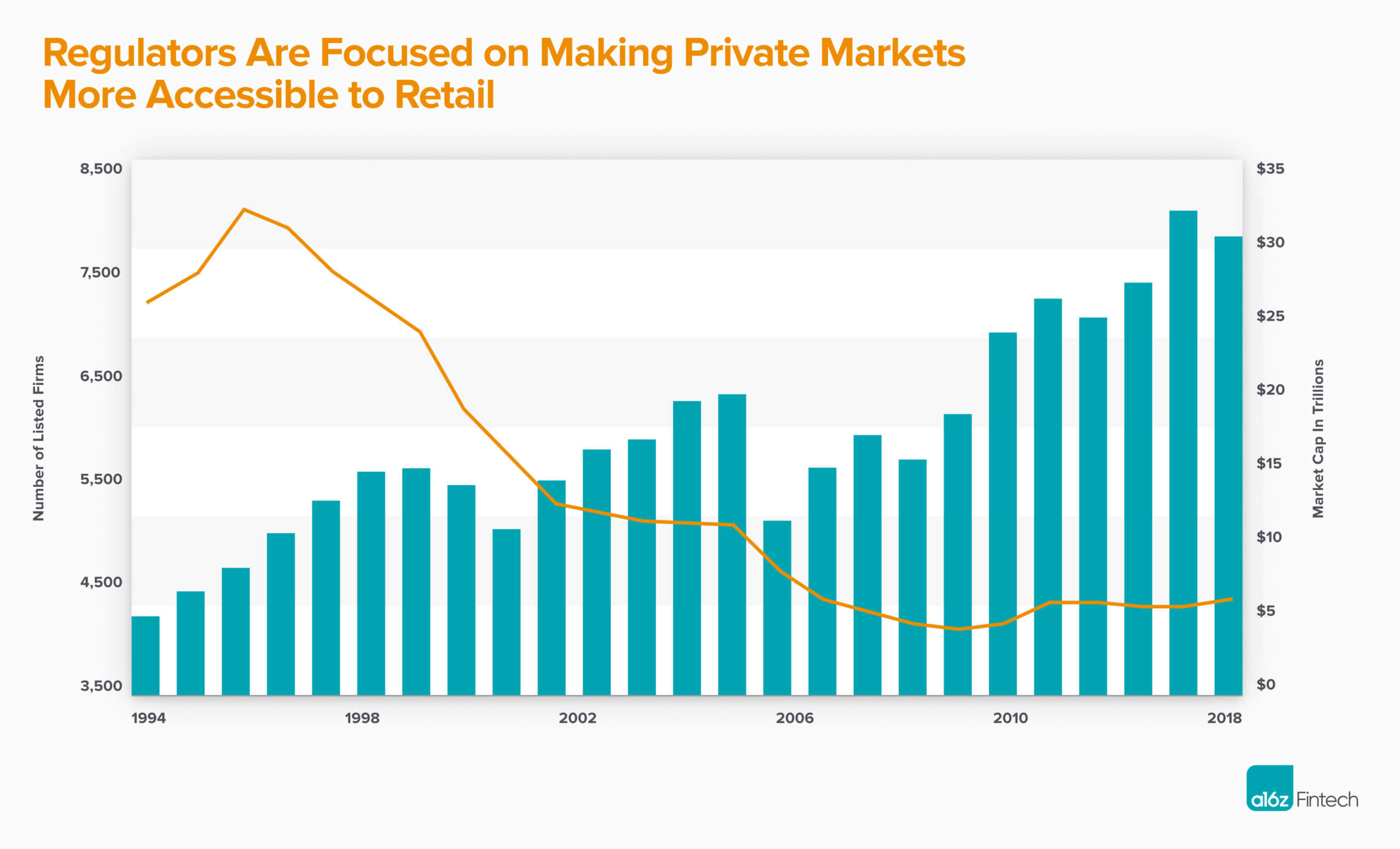

Private markets have been the domain of institutions and the wealthy, could they open to retail investors? – The European Sting - Critical News & Insights on European Politics, Economy, Foreign Affairs,

Risks | Free Full-Text | An Analysis of the Financial Liquidity Management Strategy in Construction Companies Operating in the Podkarpackie Province

Private and public liquidity provision in over‐the‐counter markets - Arseneau - 2020 - Theoretical Economics - Wiley Online Library

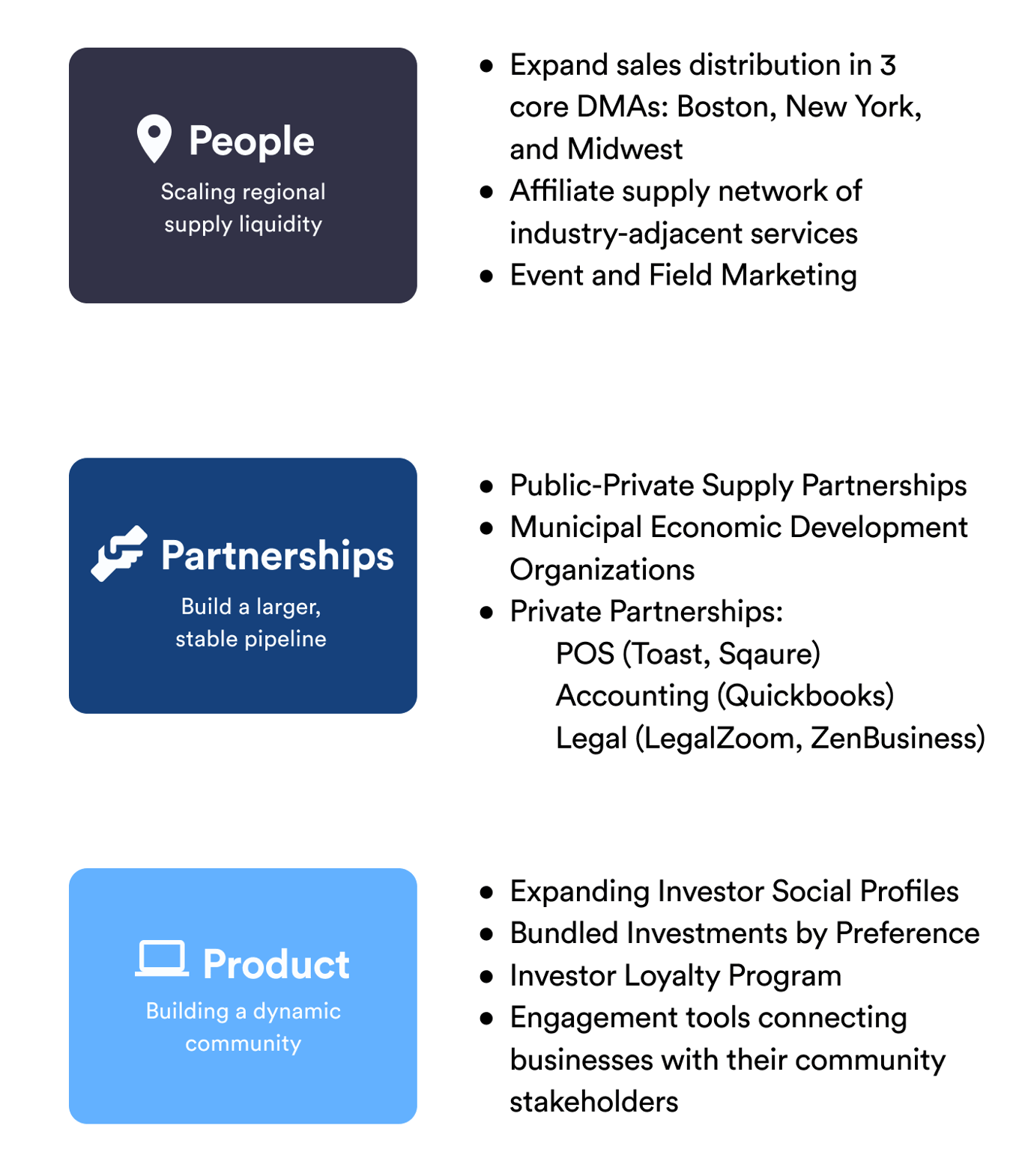

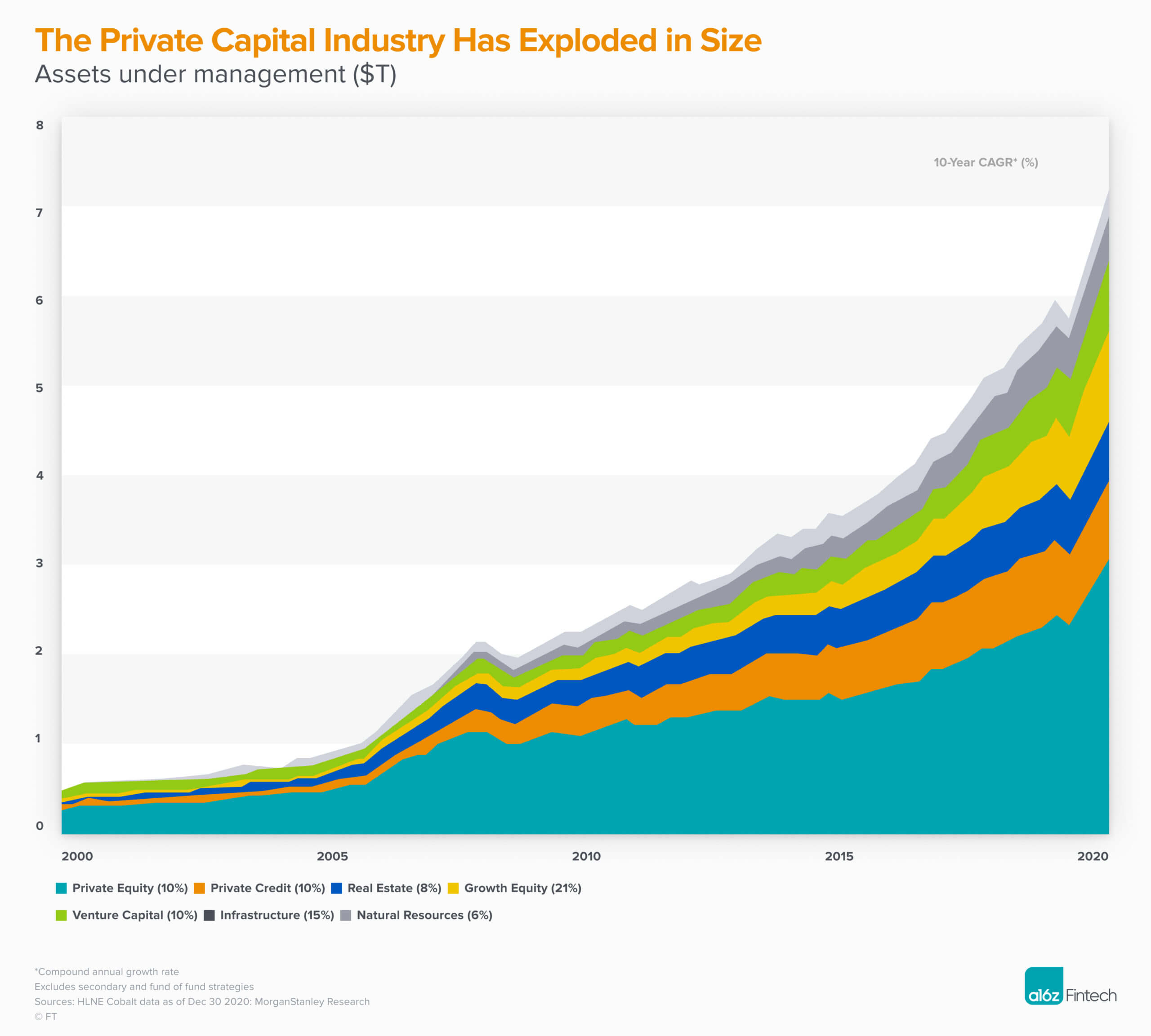

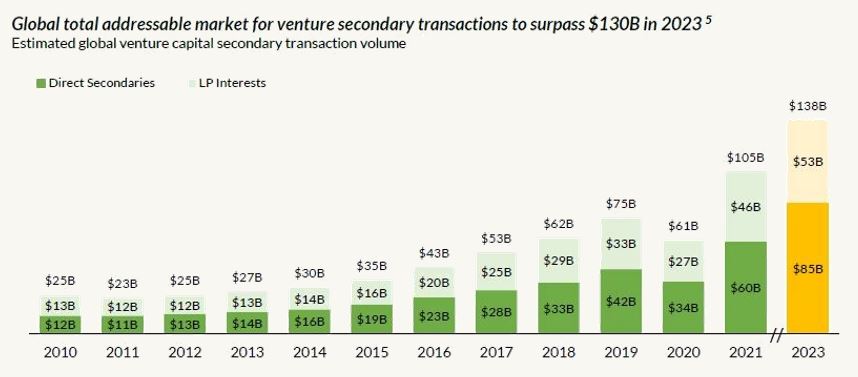

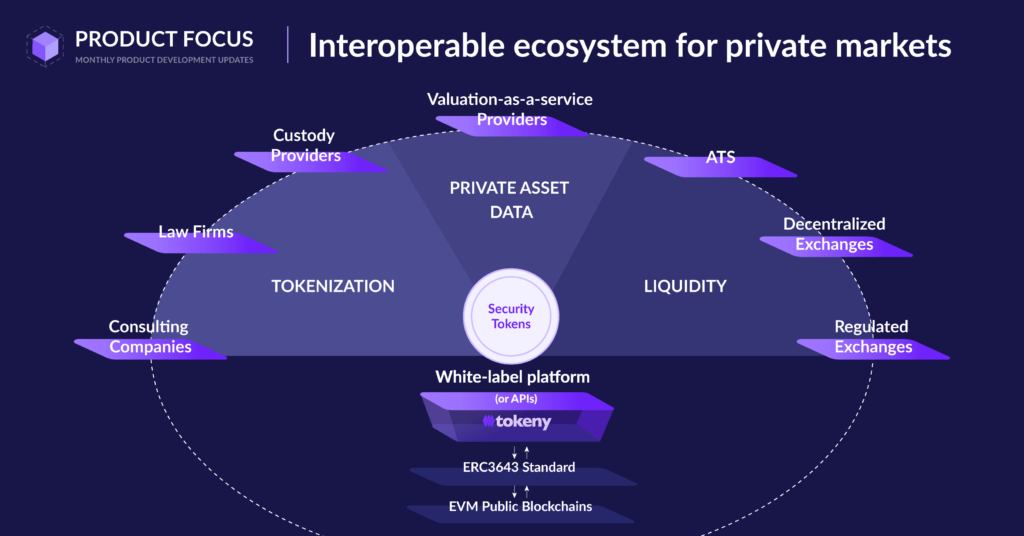

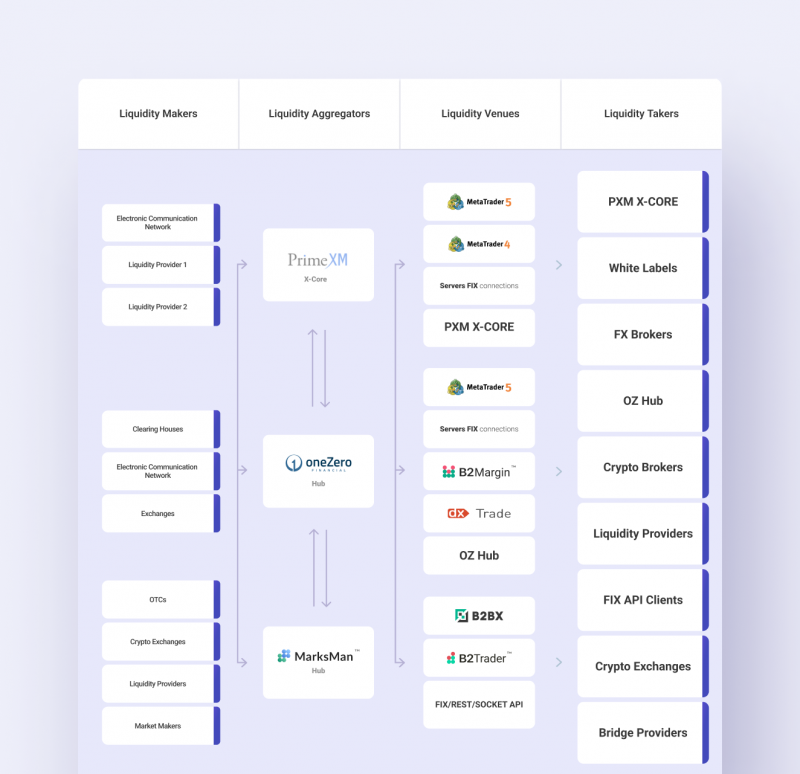

Come for the Tool, Stay for the Exchange: Bootstrapping Liquidity in the Private Markets | Andreessen Horowitz

Come for the Tool, Stay for the Exchange: Bootstrapping Liquidity in the Private Markets | Andreessen Horowitz

:max_bytes(150000):strip_icc()/pipe_final-169e45df98a54ef7b4c685950e9f131f.png)